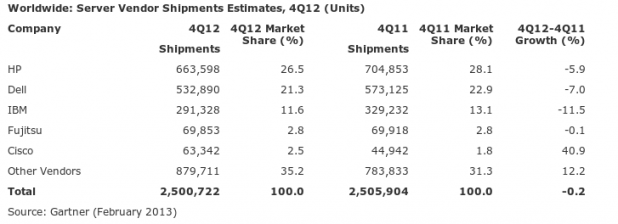

The results for the quarter centered on demand for x86 servers, which boosted shipments by 0.2 percent and revenue by 6.6 percent. Relatively weak mainframe and RISC/Itanium Unix platform market performance kept overall revenue growth in check. In terms of actual servers sold, IBM sank to third place behind Hewlett-Packard and Dell, which retained their hold as the first- and second-ranked server vendors. The market leader continued to be the "other" category, which grew to 35.2 percent of the market, up 12 percent from a year ago. "Other" vendors sold 879,711 servers. Unfortunately, neither Dell nor HP retained their positions through positive growth; HP's unit sales sank 5.9 percent to 663,598 servers sold, giving it a 26.5 percent share. Dell finished second, down 7.0 percent (532,890 units sold, 21.3 percent market share) and IBM sank 11.5 percent (291,328 units sold, 11.6 percent share). Fujitsu and Cisco finished fourth and fifth, with 2.8 percent and 2.5 percent share, respectively; Cisco, at least, saw unit growth soar by 40.9 percent. Gartner said that blade sales grew 3.2 percent in revenue, but declined 3.8 percent in shipments, with HP, at 43.9 percent, selling the majority.

The results for the quarter centered on demand for x86 servers, which boosted shipments by 0.2 percent and revenue by 6.6 percent. Relatively weak mainframe and RISC/Itanium Unix platform market performance kept overall revenue growth in check. In terms of actual servers sold, IBM sank to third place behind Hewlett-Packard and Dell, which retained their hold as the first- and second-ranked server vendors. The market leader continued to be the "other" category, which grew to 35.2 percent of the market, up 12 percent from a year ago. "Other" vendors sold 879,711 servers. Unfortunately, neither Dell nor HP retained their positions through positive growth; HP's unit sales sank 5.9 percent to 663,598 servers sold, giving it a 26.5 percent share. Dell finished second, down 7.0 percent (532,890 units sold, 21.3 percent market share) and IBM sank 11.5 percent (291,328 units sold, 11.6 percent share). Fujitsu and Cisco finished fourth and fifth, with 2.8 percent and 2.5 percent share, respectively; Cisco, at least, saw unit growth soar by 40.9 percent. Gartner said that blade sales grew 3.2 percent in revenue, but declined 3.8 percent in shipments, with HP, at 43.9 percent, selling the majority.

HP, Dell Server Sales Swallowed Up by 'Other' Vendors: Gartner

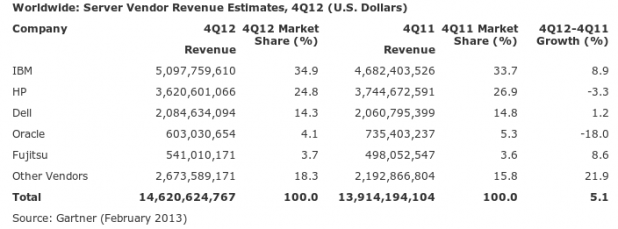

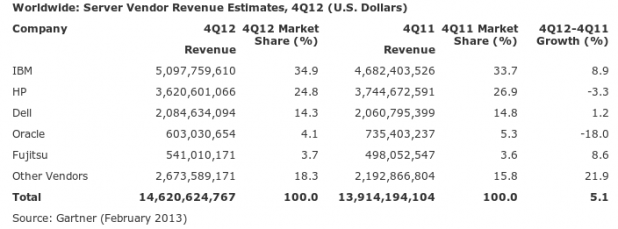

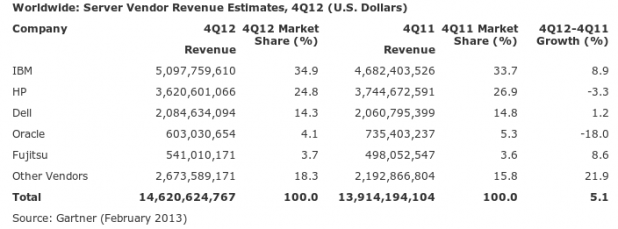

Server sales were flat in the fourth quarter, estimates research firm Gartner, thanks in part to virtualization-driven consolidation. While server-related revenues grew 5.1 percent, budget constraints weighed on overall server sales. The industry shipped a total of 2.501 million servers, down slightly from 2.505 million servers sold a year ago. Total server revenue topped $14.6 billion, up from $12.6 billion last quarter. Once again, the server vendors responsible for generating the most revenue weren’t necessarily those that sold the most servers. Thanks to a lineup of pricey machines, IBM and Oracle ranked high in revenue—first and fourth place, respectively—while somewhat lower in actual units shipped. None of the top five server vendors, with the exception of Cisco, actually increased server sales during the quarter. In fact, growth came from only the Web's top players—Baidu, Facebook, and Google. Both Google and Facebook have been designing and building their own servers, which could end up stealing even more share away from the top vendors. “2012 was a year that definitely saw budgetary constraint which resulted in delays in x86-based server replacements in enterprise and mid-sized data centers,” Jeffrey Hewitt, research vice president at Gartner, wrote in a statement. (Rival IDC is expected to provide its own server-related numbers soon, which generally are in line with Gartner's numbers.) IBM easily generated the most server revenue of any of the major players, with $5.10 billion in the fourth quarter. That captured 33.7 percent of all revenue, topping Hewlett-Packard ($3.62 billion in revenue, 24.8 percent market share), Dell ($2.08 billion, 14.3 percent), and Oracle ($603 million, 4.1 percent). Oracle saw its server sales slide by 18 percent:  The results for the quarter centered on demand for x86 servers, which boosted shipments by 0.2 percent and revenue by 6.6 percent. Relatively weak mainframe and RISC/Itanium Unix platform market performance kept overall revenue growth in check. In terms of actual servers sold, IBM sank to third place behind Hewlett-Packard and Dell, which retained their hold as the first- and second-ranked server vendors. The market leader continued to be the "other" category, which grew to 35.2 percent of the market, up 12 percent from a year ago. "Other" vendors sold 879,711 servers. Unfortunately, neither Dell nor HP retained their positions through positive growth; HP's unit sales sank 5.9 percent to 663,598 servers sold, giving it a 26.5 percent share. Dell finished second, down 7.0 percent (532,890 units sold, 21.3 percent market share) and IBM sank 11.5 percent (291,328 units sold, 11.6 percent share). Fujitsu and Cisco finished fourth and fifth, with 2.8 percent and 2.5 percent share, respectively; Cisco, at least, saw unit growth soar by 40.9 percent. Gartner said that blade sales grew 3.2 percent in revenue, but declined 3.8 percent in shipments, with HP, at 43.9 percent, selling the majority.

The results for the quarter centered on demand for x86 servers, which boosted shipments by 0.2 percent and revenue by 6.6 percent. Relatively weak mainframe and RISC/Itanium Unix platform market performance kept overall revenue growth in check. In terms of actual servers sold, IBM sank to third place behind Hewlett-Packard and Dell, which retained their hold as the first- and second-ranked server vendors. The market leader continued to be the "other" category, which grew to 35.2 percent of the market, up 12 percent from a year ago. "Other" vendors sold 879,711 servers. Unfortunately, neither Dell nor HP retained their positions through positive growth; HP's unit sales sank 5.9 percent to 663,598 servers sold, giving it a 26.5 percent share. Dell finished second, down 7.0 percent (532,890 units sold, 21.3 percent market share) and IBM sank 11.5 percent (291,328 units sold, 11.6 percent share). Fujitsu and Cisco finished fourth and fifth, with 2.8 percent and 2.5 percent share, respectively; Cisco, at least, saw unit growth soar by 40.9 percent. Gartner said that blade sales grew 3.2 percent in revenue, but declined 3.8 percent in shipments, with HP, at 43.9 percent, selling the majority.

The results for the quarter centered on demand for x86 servers, which boosted shipments by 0.2 percent and revenue by 6.6 percent. Relatively weak mainframe and RISC/Itanium Unix platform market performance kept overall revenue growth in check. In terms of actual servers sold, IBM sank to third place behind Hewlett-Packard and Dell, which retained their hold as the first- and second-ranked server vendors. The market leader continued to be the "other" category, which grew to 35.2 percent of the market, up 12 percent from a year ago. "Other" vendors sold 879,711 servers. Unfortunately, neither Dell nor HP retained their positions through positive growth; HP's unit sales sank 5.9 percent to 663,598 servers sold, giving it a 26.5 percent share. Dell finished second, down 7.0 percent (532,890 units sold, 21.3 percent market share) and IBM sank 11.5 percent (291,328 units sold, 11.6 percent share). Fujitsu and Cisco finished fourth and fifth, with 2.8 percent and 2.5 percent share, respectively; Cisco, at least, saw unit growth soar by 40.9 percent. Gartner said that blade sales grew 3.2 percent in revenue, but declined 3.8 percent in shipments, with HP, at 43.9 percent, selling the majority.

The results for the quarter centered on demand for x86 servers, which boosted shipments by 0.2 percent and revenue by 6.6 percent. Relatively weak mainframe and RISC/Itanium Unix platform market performance kept overall revenue growth in check. In terms of actual servers sold, IBM sank to third place behind Hewlett-Packard and Dell, which retained their hold as the first- and second-ranked server vendors. The market leader continued to be the "other" category, which grew to 35.2 percent of the market, up 12 percent from a year ago. "Other" vendors sold 879,711 servers. Unfortunately, neither Dell nor HP retained their positions through positive growth; HP's unit sales sank 5.9 percent to 663,598 servers sold, giving it a 26.5 percent share. Dell finished second, down 7.0 percent (532,890 units sold, 21.3 percent market share) and IBM sank 11.5 percent (291,328 units sold, 11.6 percent share). Fujitsu and Cisco finished fourth and fifth, with 2.8 percent and 2.5 percent share, respectively; Cisco, at least, saw unit growth soar by 40.9 percent. Gartner said that blade sales grew 3.2 percent in revenue, but declined 3.8 percent in shipments, with HP, at 43.9 percent, selling the majority.